Making Taxes Fun & Easy

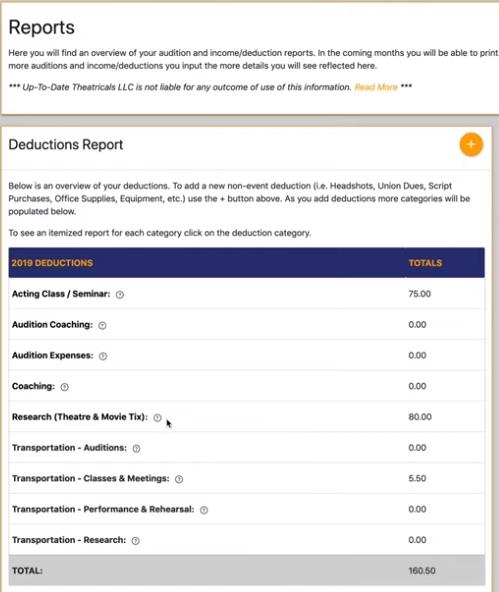

Navigating taxes as a working actor or performing artist can be tricky, especially if you’re new to the industry. At Up-To-Date Actor, we encourage all actors and performing artists to record all their appointments, meetings, networking events, coaching sessions, classes, rehearsals, and performances. Every time you log an audition or a meeting and enter any affiliated cost, e.g., transportation costs, the Up-To-Date Actor Database will tally all of your associated deductions.

When you add a meeting with an industry contact or personal contact, our database will make note of it so you have an organized paper trail of your career expenses and how to account for them once it’s time to do your taxes.

Adding Events for Tax Deductions is Easy and Convenient

The sad truth is that many performers procrastinate bookkeeping or getting their tax matters in order because they are overwhelmed by the thought of it. This makes sense, but it doesn’t have to be this way! Delaying or avoiding doing your taxes as a working actor may lead to missed opportunities for tax deductions. It takes much less time recording your deductions as they happen versus cramming it all in at tax time. Plus, performers could be overlooking opportunities to take deductions that the average taxpayer cannot. To start taking advantage of these deductions, the first step is to fully commit to the mindset that your acting or performance career is a business. Record keeping is an important aspect of operating any business, so it’s on you to treat it as such.

Although the 2017 tax reform law impacted the performing arts, performing artists are still advised to keep an organized log of their events and income to use for deductions. Additionally, lobbyists are continuously working to bring back the exemptions that performing artists lost. Should you run into issues, you can also take all of the standard performing arts deductions for any work associated with a 1099 contract or with deferred pay. Furthermore, record keeping helps define you as a professional actor. It’s not necessarily about the amount of money you make but how you account for it.

The main takeaway is to make your time and money work for you; this means recording and documenting everything associated with the business of being a working actor and/or performer. Up-To-Date Actor can help simplify these processes.

*** Up-To-Date Actor reports in no way guarantee specific tax or legal outcome. Up-To-Date Theatricals LLC provides basic tax and bookkeeping information to aid in the keeping of business records and is not designed to be a comprehensive tax guide, may not address your specific circumstances and should not be considered a source for tax preparation. Up-to-Date Theatricals LLC highly recommends that you always seek tax preparation and advice from a competent, trained theatrical tax preparer. Neither the author, contributors or publisher of this site are engaged in rendering legal, accounting or other professional services and are not liable for any tax consequences that an individual person may incur from using the suggested information, forms or reports. By using the Up-To-Date Actor for tax purposes you acknowledge this and hold Up-To-Date Theatricals LLC not liable. ***

Here is a video tutorial on adding events and how they can help with your record keeping:

How to Add Events and Record Your Expenses

The first tip we’ll provide for simplifying taxes as a performer is to keep all of your receipts. It is an absolute must that you know where all of your receipts are before you even start adding events. Receipts are the most reliable documentation for expenses and purchases, especially if they feature the following information:

- Name and address of the vendor or service provider

- Date of purchase or service

- Itemized descriptions of the purchase or service

If a physical copy of a detailed receipt is not available, always request a digital record documenting that you attended an event.

Organize your receipts by type of expense or type of income. You can store each type of income receipt, income contract, business expense, or other statements of income in a separate digital file, accordion file, or envelope. UTDA allows you to take a photo of a physical receipt and attach it to an event and/or deduction.

*Below are examples of some of the different ways you can use UTDA. We advise adding each event and/or deduction as they occur

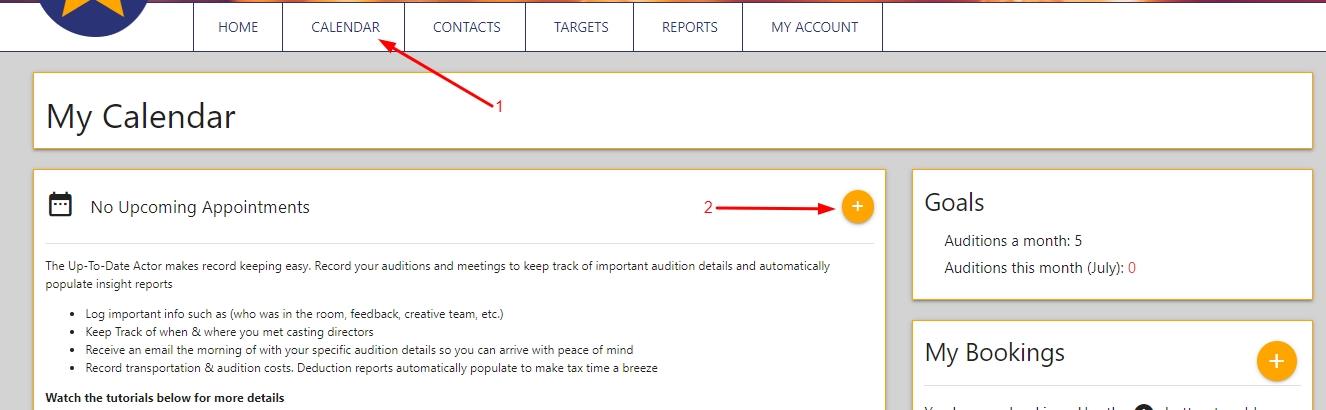

Once you have your documents in order, proceed to input the information into your Up-To-Date account. To enter an event based deduction, i.e., audition, meeting, class, etc., start the process by navigating to the Calendar page.

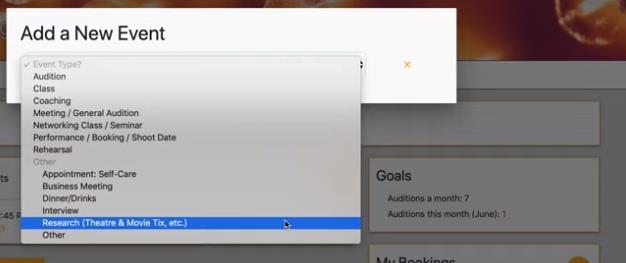

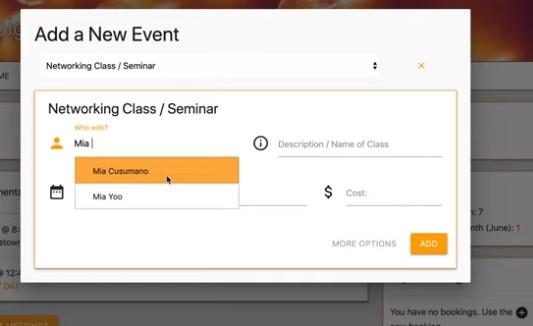

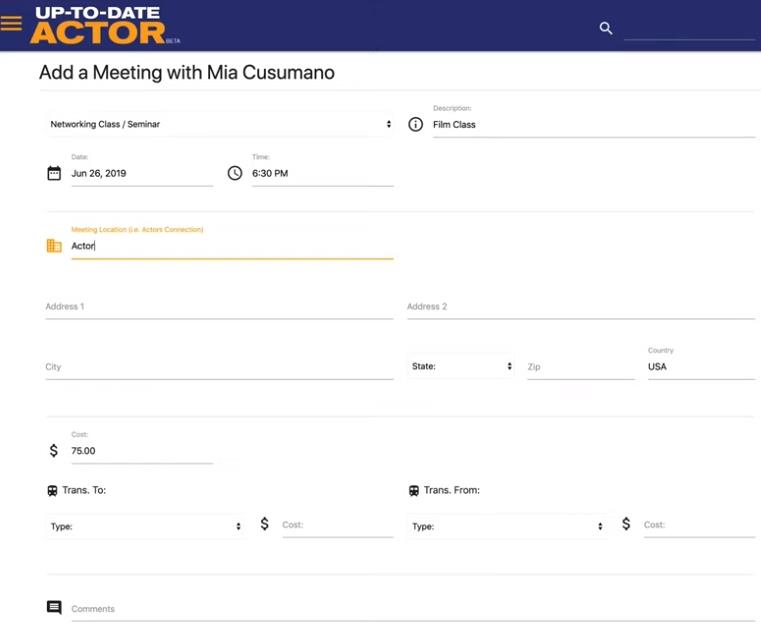

Select the type of event you are planning to attend or have attended, i.e., Research, Business Meeting, Networking Class, etc. Remember to input the estimated cost of participating in an event.

Whenever an item is available in a drop-down list, click it instead of manually typing it out. This helps Up-To-Date’s Database improve your experience in the long run.

Clicking MORE OPTIONS allows you to be more specific with your expenses.

It is important to record as many expenses as possible, and be as thorough as possible. Our automated deduction reports are designed to make taxes for actors and performers easier.

Types of Expenses that are Tax Deductible

Accompanist & Audition Prep Expenses

Common expenses include hiring an audition accompanist, contracting computer music transcriptions and arrangements, and purchasing vocal audition book supplies.

Advertising Fees

Deductibles include advertising and promotional expenses related to finding work, getting an agent, career promotion, and more. Typical deductions for theatre artists are resumes, postcards, photographers, photocopies, press kits, theatre tickets for agents, website development, IMDB, social media ads, press agent, and more.

Automobile Expenses

There are two ways to deduct the costs of operating a car for business purposes.

Option 1: Deduct the actual operating costs incurred during business trips (i.e., gas, oil, tires, repairs, rental and leasing fees, etc.)

Option 2: Use the IRS flat mileage allowance. At the end of the year, your tax preparer will use this information to obtain the largest deduction possible.

Agent/Manager Commissions and Fees

List all commissions and fees paid to agents and managers. File letters sent by agents and managers. These documents help explain the nature of procured services and your contracts.

Business Entertainment Expenses

Business dinners, meetings, and other events associated with getting work or representation may be tax deductible. Business entertainment meetings at a restaurant are now 100% deductible, through December 31, 2022. Business entertainment and meal expenses conducted outside of restaurant settings, however, remain 50% deductible.

If you are employed as an employee or an independent contractor, you can deduct production meeting costs. These meetings must be held in connection with your employment.

Cast parties and open houses are not tax-deductible expenses. They may be deducted if they are proven to help promote your business.

Receipts for these events must document projects discussed, all present individuals, their titles and business affiliations, date, and the location. If the business meeting was hosted at home, keep receipts pertaining to groceries, catering services, liquor, and other expenses.

Costs of Business Gifts

Record each business gift with an original receipt. The IRS limits deductions for business gifts to one $25 gift per recipient per year.

Fees for Classes, Coaching Services, and other Lessons

All professional instruction, coaching, dance classes, and other training deemed necessary to maintain and improve a theatre artist’s skills are deductible. We recommend keeping names, addresses, and business cards of all instructors. The IRS may question the validity of these receipts without such documentation. Some theatrical tax preparers also send photocopies of receipts for classes, including the names and addresses of instructors and schools, and the income tax return.

Typical deductions for theatre artists include acting lessons, dance lessons, vocal lessons, speech lessons, dialect classes, career consultations, adn related forms of training.

Costume and Dancewear Maintenance Fees

Although theatrical costumes are deductible, the clothing that you wear for auditions or general theatre work is not automatically deductible. If a piece of clothing can be worn for daily activities, it is not considered a costume and cannot be deducted. If you are seeking a deduction on the cost of dance clothes, the IRS may request evidence of you attending dance class or having performed using these clothes. Cleaning and repair expenses for theatrical costumes are typically tax deductible.

Equipment/Equipment Maintenance Fees

The cost of purchasing or renting equipment for professional purposes is usually tax deductible. For example, purchasing audio recorders, pianos, keyboards, stereo systems, self-taping equipment, and getting piano tuning services may all qualify. Performing artists should keep their equipment purchase expenses separate from general equipment maintenance expenses.

There are two methods to claim deductions for large equipment purchases. You can work with a tax preparer to determine if you should deduct the costs over a five-year depreciation or all in one year. If you are using a piece of equipment for personal and business applications, you can only claim a deduction based on how much it was used for business. For example, if you used a smartphone to record a self-taped audition, you could submit to write off the device for that usage but not for all the other times you used the smartphone for personal use.

Internet & Cable Bills

Performing artists can claim deductions for running advertisements, facilitating Internet audition submissions, sending industry emails, and researching contacts, TV shows, and films. The specifics of how this works with your Internet and cable bills should be discussed with a professional tax preparer who has experience working with actors and/or performers.

Legal and Accounting Fees

All legal and accounting fees related to your business are tax deductible. Theatre artists typically pay for income tax preparation, contracts, lawyer fees, accountant fees, and related expenses.

Make-up and Hair Expenses

Make-up and hair are only tax deductible when incurred for a performance. Routine trips to the barber or beauty salon are NOT deductible and will be questioned by the IRS. If a producer, director, or agent has made a special request for you to change your hairstyle or has required specific make-up for a performance or gig, make sure to get their request in writing (physical or digital). These written requests should feature the name of the production, the dates performed, and the specifics of the request.

Typical expenses in this category include theatrical make-up, audition make-up, dressing room supplies, wig purchases, and other hairstyle and color changes for a specific role.

Purchasing Office Supplies

Office supplies purchased for business purposes are tax deductible. These items include, but are not limited to stationery, artists’ supplies, postage, bank charges, and mailing envelopes.

Production and Rehearsal Prop Expenses

Expenses for rehearsal and production props are deductible whenever they are not reimbursed by the producer.

Paying for Scripts, Books, Scores, and Sheet Music

Materials purchased in preparation for upcoming roles or to improve one’s performance career are tax deductible. These include theatre books, records, tapes, violin strings, rosin, guitar picks, and related materials.

Buying Stage Manager Supplies

Rehearsal and production preparation props (i.e., kits, blacks, tools, etc.) are deductible whenever they are not reimbursed by the producer.

Studio Rental Fees

Expenses incurred for renting rehearsal studios and theatres are tax deductible. These deductions cover the rental of pianos, CD players, lights, microphones, projectors, and other related costs such as janitor fees and electricity.

Paying for Telephone-Answering Services

The cost of an answering service outside of a performing artist’s home is fully tax deductible. If you install a phone exclusively for business use, its installation and monthly fees should be deductible. If your devices are subject to both personal and business use, you can only deduct based on the percentage of time you use the device to conduct business.

Ticket Purchases for Research

Although once a typical deduction, tickets for research purposes are now a questionable deduction even if you are self-employed as an independent contractor. Some more common deductions in this category for performing artists include the cost of attending movies, plays, and concerts to observe trends in the industry and to maintain/improve one’s skills in the profession.

In order to document these expenses, make note of the date, the location, and the business-related reason you were in attendance. Then consult your tax preparer for the current IRS guidelines.

Tips for Backstage Crew

Giving tips to backstage personnel (i.e., dressers, doormen, etc.) are tax deductible. Additionally, trade publications with audition information about the business are tax deductible. This includes Up-To-Date Theatricals Agent, Casting Director books, Backstage, Variety, The Hollywood Reporter, and many others.

Transportation Expenses

The costs associated with hiring a taxi service or renting a car may be eligible for tax deductions. It is expected that you’ll incur transportation expenses for attending auditions, callbacks, interviews, business meetings, business meals, agent meetings, go-sees, theatrical rehearsals, unpaid showcases, call-board checks (e.g., AEA, SAG, and AFTRA), tax consultations, collecting scripts/audition sides, and posting professional mails.

It is important to note that transportation expenses to and from W2 jobs are not tax deductible, especially if they are in the same town or vicinity in which you are located. If you travel from one job to another on the same day, transportation from the first job to the second is deductible. For example, if you need to travel directly to perform at a nightclub after performing in a Broadway show, the cost of that trip is tax deductible. The taxi ride home from your nightclub gig, however, is not tax deductible. If you own a car and use it for business purposes, keep track of these expenses and mileage in the automobile section of Business Expenses.

Union Dues, Initiation Fees & Organization Membership Fees

Fees that are paid during the tax year are deductible. Union dues are typically deducted from your paychecks, so it is important to keep records of everything.

If you are unsure of which business or personal expenses that are deductible, it is always best to consult with your professional tax advisor.